New Delhi: Income tax return filings touched a record 72.8 million by end of July, the due date for declaring income earned in FY24 that ended in March, with three-fourths of the filers opting for the new personal income tax regime, the Central Board of Direct Taxes (CBDT) said on Friday.

This is a 7.5% improvement over the total tax returns filed in the same time a year ago. It comes on top of a 16% jump seen in return filing in 2023-24 assessment year.

Last year, 67.7 million tax returns were filed by the due date. After the due date, a penalty of up to ₹5,000 applies. For those with annual income upto ₹5 lakh, the penalty of late filing is only ₹1,000.

Among this year’s tax filers, 5.85 million are first-time filers, “a fair indication of widening of tax base,” CBDT said.

Also read | ITR Filing 2024: How to file income tax returns via WhatsApp. A step-by-step guide in detail

The higher number of tax returns filed and the adoption of the new personal income tax regime show that the government’s efforts to enhance voluntary compliance and to simplify the tax regime with lower tax rates and fewer exemptions are showing results.

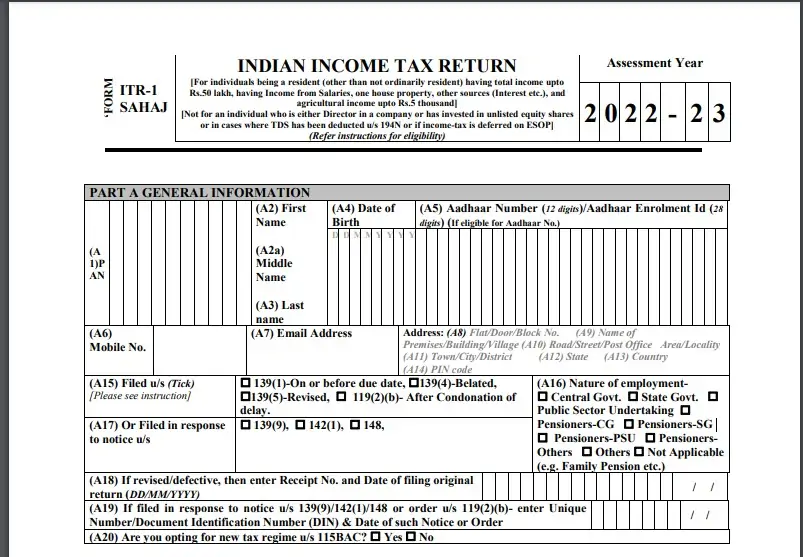

Out of the total tax returns of 72.8 million filed for the 2024-25 assessment year, 52.7 million are in the new tax regime. Only 20.1 million return forms were filed in the old tax regime, which allows exemptions like house rent allowance, interest on housing loan and leave travel allowance. “Thus, about 72% of taxpayers have opted for the new tax regime, while 28% continue to be in the old tax regime,” CBDT said.

The improving voluntary tax compliance is driven by greater oversight of transactions and use of technology, said experts.

“The Indian tax landscape has gone through a transformation over the last few years driven by technology, increased transparency, and a widening of the tax base. Rolling out the annual information statement or AIS that provides tax authorities with a comprehensive view of taxpayers’ financial information has made it much harder for taxpayers to not file their taxes properly now,” said Amit Maheshwari, a tax partner at AKM Global, a tax and consulting firm.

Also read | ITR Filing 2024: How to file income tax returns via WhatsApp. A step-by-step guide in detail

This, he said, combined with the use of advanced data analytics has added to the fear of receiving a tax notice due to discrepancies between AIS data and tax returns. “Overall, an increase in return filers is a positive indicator reflecting enhanced awareness among taxpayers to file their tax returns on time,” said Maheshwari.

The Centre expects to collect ₹22 trillion in taxes from individuals and corporations in the current financial year, which is 13.4% more than what was collected in the last financial year, according to budget estimates. This growth is faster than the nominal gross domestic product (GDP) growth of 10.5% assumed in the budget.

The income tax department has been actively engaging with tax return filers in social media, requesting those flagging difficulties in filing, to share their contact details for the department’s team from its centralized processing centre to offer a helping hand.

CBDT, the apex direct tax policy making body, said tax return filing peaked on 31 July, the due date for salaried taxpayers and other non-tax audit cases, with over 6.99 million tax returns getting filed on a single day. The e-filing portal saw its highest per hour filing of 507,000 return filing between 7pm and 8pm on 31 July.

Data showed that taxpayers were hurriedly filing their returns on the last day after working hours. Shortly after 8pm on 31 July, over 9,360 returns were getting filed per minute, CBDT stated. On 17 July morning, the fastest return filing rate of 917 returns per second was noticed.

“A lot of emphasis was provided to educate taxpayers about old and new tax regimes. ‘Frequently asked questions’ and educational videos on the same were uploaded on the e-filing portal,” CBDT said. Social media campaigns, informative videos in 12 vernacular languages apart English and Hindi were displayed on digital platforms, CBDT said.