Innomet Advanced Materials IPO: The initial public offering (IPO) of Innomet Advanced Materials, which opened for subscription on Wednesday, September 11, is concluding today (Friday, September 13). The ₹34.24 crore SME IPO has witnessed a healthy subscription from retail and non-institutional buyers.

Innomet Advanced Materials IPO subscription status

Till 12:54 pm on the third and final day of the Innomet Advanced Materials IPO, the issue had seen an overall subscription of nearly 47.40 times, receiving bids for 15,41,66,400 shares against 32,52,000 offered (excluding the market maker portion of 1,71,600 equity shares).

The retail portion was subscribed 59 times, with bids for 9,60,13,200 shares against 16,26,000 offered. On the other hand, the segment reserved for non-institutional buyers had seen a subscription of 34.8 times, receiving bids for 5,66,36,400 shares against 16,26,000 offered.

Innomet Advanced Materials IPO GMP

According to market sources, the last grey market premium (GMP) of Innomet Advanced Materials IPO is ₹95. This indicates, the shares of Innomet Advanced Materials may be listed at a premium of 95 per cent at ₹195.

Innomet Advanced Materials IPO details

Innomet Advanced Materials IPO is a fresh issue of 34.24 lakh shares. The price of the issue is fixed at ₹100 per share, and the minimum lot size is s 1200 shares. This means retail investors are required to invest a minimum ₹1,20,000 in the issue.

The company is expected to finalise the share allotment status on Monday, September 16, and successful bidders can expect the shares into their demat accounts on Tuesday, September 17. Those who fail to get the allotment will get the refund on the same day. Shares of the company are expected to be listed on the NSE SME platform on Wednesday, September 18, 2024.

The company intends to use the net proceeds from the issue to fund working capital requirements, to pay borrowings and to meet general corporate expenses.

Innomet Advanced Materials business overview

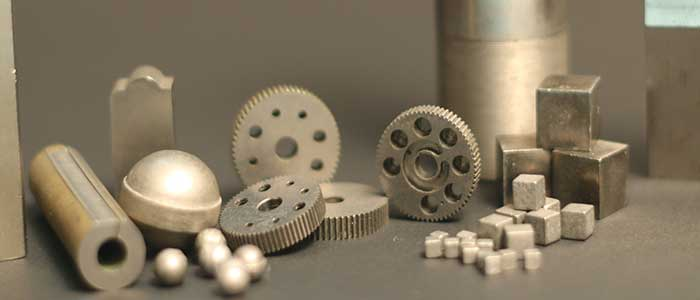

The company is a manufacturer of metal powders and tungsten-heavy alloys. It claims to offer a diverse range of over 20 products, including copper, bronze, brass, nickel, tin, and stainless-steel powders for various industries. The company has several domestic and international customers.

In FY22 and FY23, the company earned a profit of ₹55.17 lakh and ₹3.22 crore, respectively. For the last financial year (FY24), the company’s profit stood at ₹2.52 crore.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of 24onlive. We advise investors to check with certified experts before making any investment decisions.