Bajaj Housing Finance IPO: The initial public offering (IPO) of non-banking financial company (NBFC) Bajaj Housing Finance will open for subscription on September 9. The three-day bidding window will remain open for investors till September 11, 2024. The price band for the mainboard IPO will be announced on Tuesday, September 3 and the anchor book for the issue will open on Friday, September 6.

Bajaj Housing Finance was founded in 2008 and is a 100 per cent subsidiary of Bajaj Finance. Bajaj Finserv holds a 51.34 per cent stake in Bajaj Finance. Bajaj Housing Finance offers mortgage loans and is a non-deposit-taking housing finance company registered with the National Housing Bank (NHB) since 2015.

Bajaj Housing Finance IPO Details:

The housing finance firm aims to raise a total of ₹6,560 crore through the IPO, which includes a fresh issue of ₹3,560 crore and an offer for sale (OFS) of ₹3,000 crore. The cap price shall be at least 105 per cent of the floor price and less than or equal to 120 per cent of the floor price.

Kotak Mahindra Capital Company Limited, Bofa Securities India Limited, Axis Capital Limited, Goldman Sachs (India) Securities Private Limited, SBI Capital Markets Limited, Jm Financial Limited and IIFL Securities Ltd are the book running lead managers of the Bajaj Housing Finance IPO, while Kfin Technologies Limited is the registrar for the issue.

The NBFC plans to use the proceeds of the new shares to strengthen its capital base for future lending activities and cover offer-related expenses. Additionally, the listing will provide the company with benefits such as brand visibility and establishing a public market for its shares in India.

The NBFC, in its draft papers, explained the eligible shareholders who can apply for the Bajaj Housing Finance IPO under the shareholder’s category, saying, “Individuals and HUFs who are public equity shareholders of our promoters, excluding such other persons not eligible to invest in the offer under applicable laws, rules, regulations and guidelines and any depository receipt holder of our promoters.”

So, those who hold the parent company stocks (either or both) at the time of the NBFC’s RHP filing (i.e., by Saturday, August 31) will be eligible to apply for the Bajaj Housing Finance IPO under the shareholder’s category.

In order to comply with Reserve Bank of India (RBI) regulations requiring the listing of upper-layer non-banking finance companies (NBFC-UL) on the stock exchanges by September 2025, the non-deposit taking housing financier filed the draft prospectus for the ₹7,000 crore IPO with the regulator in June 2024.

Bajaj Housing Finance Company Details

The NBFC is part of the Bajaj Group and provides customized financial solutions to individuals and corporations for the purchase and renovation of homes and commercial spaces. The company’s comprehensive mortgage product range includes home loans, loan against property, rent concessions, and developer finance.

As of March 31, 2024, the company had 308,693 active customers, of which 81.7 per cent were home loan customers. The NBFC has a network of 215 branches in 174 locations across 20 states and three union territories, overseen by six centralized retail loan review centers and seven centralized loan processing centers.

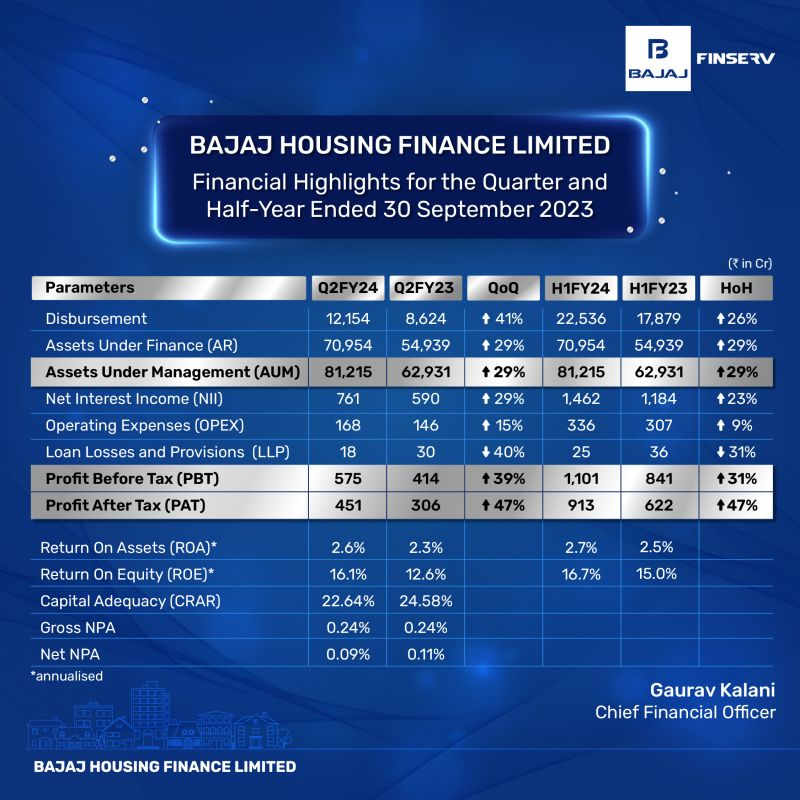

In fiscal year 2023–24, the housing lender reported a net profit of ₹1,731 crore, a 38 per cent increase from ₹1,258 crore in the previous year. As of March 31, 2024, home loans as a proportion of the corporation’s total assets under management (AUM) decreased from 61.7 per cent to 57.8 per cent.

The company’s listed peers, according to the DRHP, are PNB Housing Finance (P/E of 12.4), Can Fin Homes (P/E of 12.9), Aadhar Housing Finance (P/E of 18.7), Aavas Financiers (P/E of 3.3), Aptus Value Housing Finance (P/E of 24.6), and Home First Finance (P/E of 24.3). LIC Housing Finance has a P/E of 7.3.

In September 2022, the RBI published a list of upper-layer NBFCs, or enterprises with assets under control of ₹50,000 crores. According to RBI criteria, Bajaj Housing Finance, which was on the list, was slated to be listed on the bourses in September 2025.